Top 5 DeFi lending and borrowing platforms on Solana

When optimizing returns in DeFi investments, one of the keys is to identify efficient tools that help you execute smooth operations.

In this case we’re talking about lending and borrowing dApps that let you access truly interesting APY and Borrow rates.

Protocols focused on security, risk management and liquidity. They also come with apps and web versions that are simple to use, ready to leverage features that optimize your financial results.

Below we share the top 5 DeFi loan platforms on Solana right now, comparing their main features, differentiators, ease of use and hard data (TVL, rates, audits, activity) that back their reputation.

Kamino Finance

Kamino allows lenders to deposit their funds into “automated coffers” that distribute assets across various markets, according to the platform’s risk parameters.

In addition, this dApp runs temporary campaigns called “Seasons” to improve users’ net APYs. Added to governance benefits and rewards (Kamino Points) for those who do staking of its native token $KMNO.

An interesting aspect is that it has its own forum where any user can create an account and join the conversation about the platform’s development.

Regarding security, it has 18 external audits (5 different auditors), 3 formal verifications and has never been hacked (exploited) since its market launch in 2023.

Current data:

- Lenders (Supply APY): from 5.2%–14.2% in its V2 and 0.19%–25% in its V1. Both active.

- Borrowers (Borrow APY): 0.87%–66.81% depending on market and utilization.

- Total Value Lock (TVL): $4.38B (includes borrows).

- Debt assets: 43 (V2).

- Collateral assets: 73 (V2).

- Live markets in V2: 24; including Jito Market, xStocks Market (RWA), Bitcoin Market, Bonk Market and Pump Market.

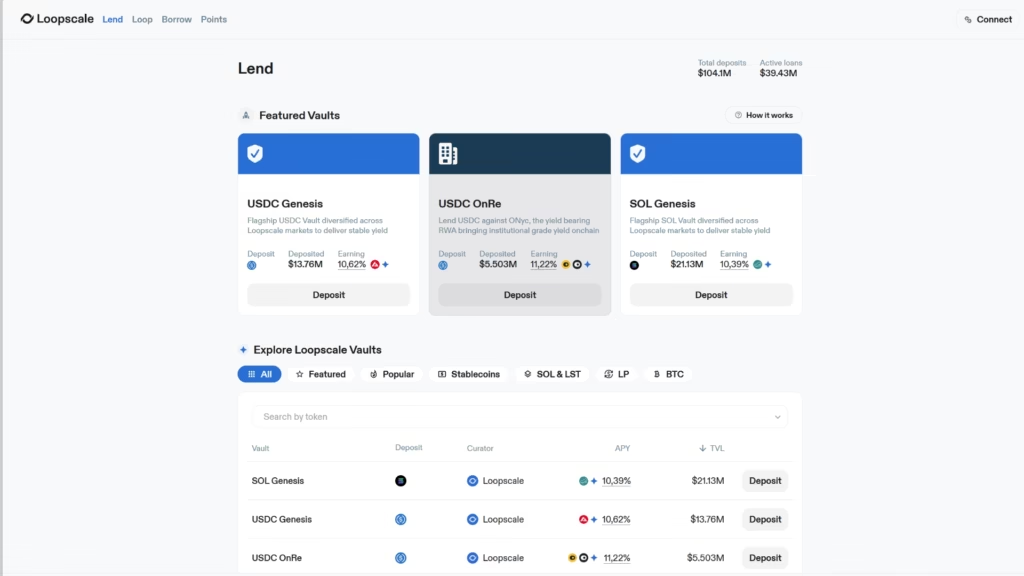

Loopscale

Loopscale stands out for having a simple, easy-to-understand UX even for very beginner users, plus the ability to create/curate vaults that diversify capital across markets, including opportunities in LSTs (Liquid Staking Tokens), LPs (Liquidity Provider Tokens) and RWA (Real World Assets).

This platform lets you lend via Curated Vaults or go straight to Advanced Lending; and if you want to squeeze returns, the Loop module builds leveraged strategies.

Its order book architecture connects lenders and borrowers with fixed rates/terms, giving more control than an algorithmic pool. It also has a points program visible in the app.

It features a non-custodial design on Solana (your money is never held by the company; it stays in your wallet and in open smart contracts) and isolated markets to limit risk across assets.

Current data:

- Lenders (Supply APY): Between 0.1%–11.98%.

- Strategy potential: up to ~220% APY integrating Loops.

- Borrowers (Borrow APR): Between 0.1%–10%; product bundles advertise up to 2%.

- Total deposits: ~$104.4M.

- Active loans: ~$41.1M.

- Collateral assets: 220.

- Assets with lending market: 20 (SOL, USDC, zBTC, JitoSOL, wfragSOL, BONK, USDT/USDC/EURC, PYUSD, CRCLx, etc.).

- Vaults available to lend: 36; including advanced lending.

You might also be interested in reading: How to earn yields from DeFi lending and borrowing

Drift

Drift was born as a perps DEX on Solana and today adds a lending & borrowing stack in the same app. You can lend in the main market or in Isolated Pools (JLP Market, LST Market, Exponent) to isolate risk by pool.

If you’re looking to squeeze returns, Amplify builds loops with leverage on deposits. Not forgetting that, as in any strategy, higher returns imply higher risk.

The UI (Earn → Borrow/Lend) makes tracking easy: it shows Net APY, Borrow APY, Health, LTV, remaining capacity and charts by asset/pool.

As for governance features, staking $DRIFT (DSMM) gives fee discounts and rewards for using the protocol.

Current data:

- Lenders (Supply/Earning APY): approx. 0–30% depending on asset and usage.

- Borrowers (Borrow APY): approx. 0–11% in spot markets.

- Amplify: max APYs >140% in pairs like JLP/USDC (leveraged yield).

- Total deposits: ~$1.16B.

- Active loans: ~$322M.

- Assets with lending market: 45+ available.

Save

Save (formerly Solend) is a native Solana money market with three main pools for lending and borrowing operations: Main Pool, JLP Pool and Turbo SOL Pool. Likewise, any user can create their own liquidity pool.

The platform is clear, fast and has an optimized mobile version.

A standout aspect is that it has its own LST called saveSOL. Users can stake SOL, receive saveSOL (APR ~6.23%) and use it as collateral or as a debt asset.

It also has isolated pools for specific strategies and a Points & Rewards system with a leaderboard.

Current data:

- Lenders (Deposit APR): Up to 15.93% depending on asset/pool. E.g.: SOL 2.11%, USDC 5.43%, USDT 6.14%.

- Borrowers (Borrow APR): approx. 0.00%–31.27%; in isolated/meme assets there can be spikes (e.g.: TRUMP 31.27%).

- TVL (includes borrows): ~$413M.

Rain.fi

One of this platform’s notable aspects is its constitution as a P2P market by order/book. Here, the liquidity pools that make loans possible are created and configured by individual users, who determine parameters such as rates, terms and accepted collaterals.

This dApp, audited by Halborn, lets you use RECC’s RWAs as collateral (e.g., request a USDC loan) and offers an interface that’s easy to understand and optimized with features to visualize relevant information.

In addition, in its Liquid section you can borrow against your staked tokens (without unstaking or losing rewards), useful to avoid missing market opportunities.

Current data:

- TVL: $1.63M.

- Active loans last 24h: 224

- Loan volume last 24h: $217,269 USD

- Lenders (APY over 30d): Active APY between 0.51% and 133.31%; Passive between 0.02% and 20.20%.

FAQS

At RECC we strive to deliver as much value as possible to our users, so we share key and useful information to stay up to date on updates, news and developments in the DeFi and Real Estate investment industry.

Below: answers to common questions that arise when we talk about DeFi lending and borrowing platforms.

What’s the best DeFi lending platform on Solana?

Currently the most used money market protocol on Solana is Kamino, with TVL growth above 101% from October 2024 to the same month of 2025. Likewise, the choice of a DeFi lending and borrowing platform will also depend on each user’s operational fit.

What determines one platform gives better yield than another?

There are numerous factors that influence returns, APY or yields generated on DeFi lending and borrowing platforms; some of them are the volume of deposited funds, community adoption, and the configuration of the protocol’s code.

Conclusion

Solana is an interesting ecosystem for the development of DeFi lending and borrowing platforms, where it’s common to find easy-to-use protocols, with features that increase investors’ returns and loan offers with attractive borrow rates.

Don’t forget you can invest in a RECC property, use the RPST that represents your participation in the operation as collateral on Rain.fi and implement loophole strategies that optimize your investment yield. The security of Real Estate together with the liquidity and flexibility of DeFi.